Small businesses often require external funding to support their operations and expansion. Exploring different funding options is crucial for securing the necessary capital. This involves researching various avenues, from traditional loans to alternative financing methods. Thorough research is key to finding the most suitable funding option for your specific needs. Traditional loans, such as bank loans and SBA loans, offer established structures and predictable terms. However, they often require extensive documentation and may have stringent eligibility criteria. Understanding the requirements and navigating the application process is essential for securing a loan. Alternative financing options, such as crowdfunding and venture capital, offer unique advantages and may be more accessible for certain businesses. Evaluating the pros and cons of each funding option is crucial for making an informed decision. Consider factors such as interest rates, repayment terms, and eligibility criteria. Comparing different options and understanding the associated risks and rewards is essential for selecting the most suitable funding source. This will help you make the best financial decisions for your business.

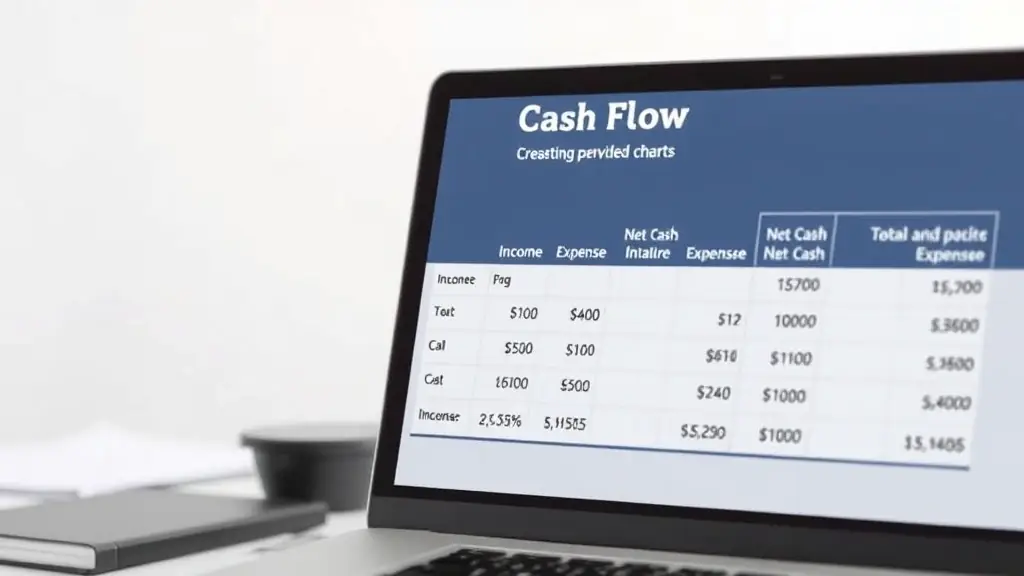

Cash Flow Management Strategies for Small Businesses

Effective cash flow management is critical for small businesses to ensure smooth operations and avoid