Financial planning is a crucial aspect of running a successful small business. It involves developing a roadmap for achieving your financial goals and objectives. This includes creating a clear vision for the future and outlining the steps needed to achieve it. A well-defined financial plan provides a framework for making informed decisions. Developing a financial plan involves forecasting future revenue and expenses, identifying potential risks and opportunities, and creating contingency plans. This process requires careful analysis of market trends and industry dynamics. Understanding your financial position and future projections is essential for making informed decisions. Implementing a financial plan involves allocating resources effectively, monitoring progress, and making necessary adjustments. This requires a proactive approach to financial management. Regular review and adjustments are essential to ensure the plan remains aligned with your business’s evolving needs. This will help you achieve your financial goals and maintain a healthy financial position.

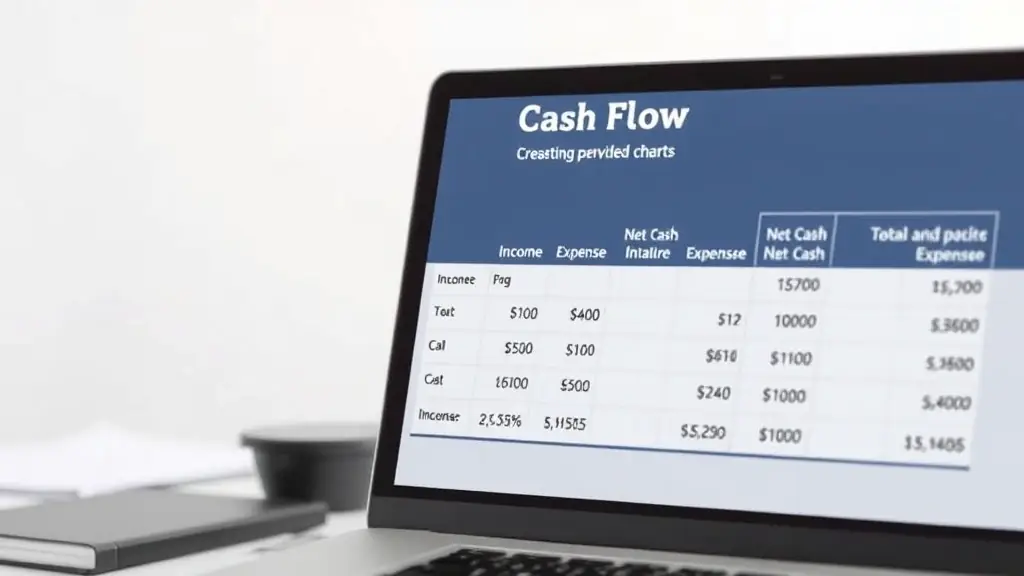

Cash Flow Management Strategies for Small Businesses

Effective cash flow management is critical for small businesses to ensure smooth operations and avoid