Budgeting is a fundamental aspect of financial management for any small business. A well-structured budget allows you to track income and expenses, anticipate potential challenges, and make informed decisions. It’s a critical tool for maintaining financial stability and achieving your business goals. Understanding your financial position is the first step towards success. Creating a comprehensive budget involves analyzing your income sources, identifying fixed and variable expenses, and forecasting future financial needs. This process requires careful consideration of all aspects of your business operations. Accurate data collection and analysis are essential for creating a realistic and effective budget. Regular review and adjustments are also necessary to ensure the budget remains aligned with your business’s evolving needs. Implementing a budget involves allocating resources effectively across different departments and projects. This requires careful planning and prioritization. Regular monitoring and reporting are essential to track progress and identify any deviations from the planned budget. By closely monitoring your budget, you can proactively address any potential financial issues and maintain control over your finances.

Cash Flow Management Strategies for Small Businesses

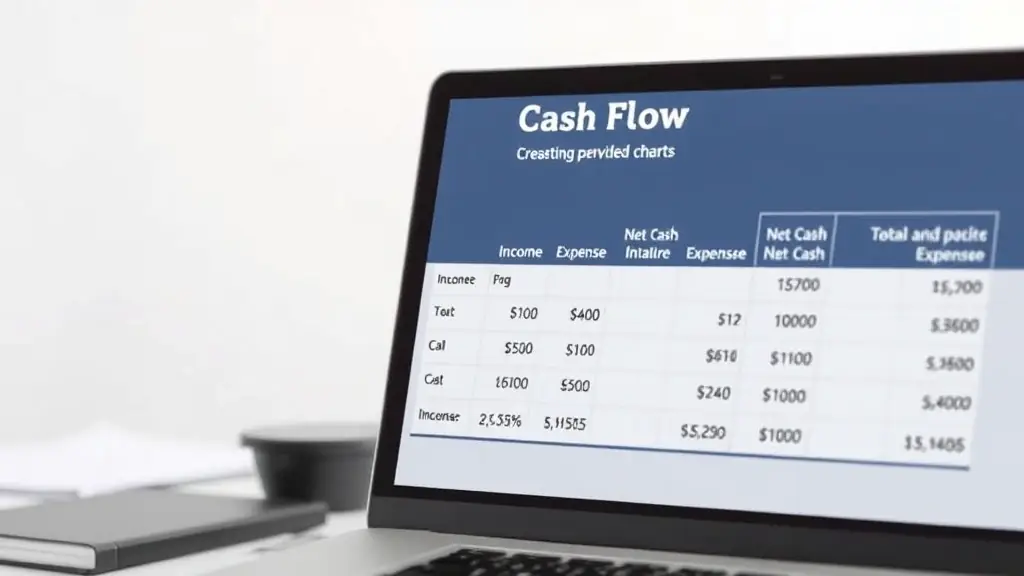

Effective cash flow management is critical for small businesses to ensure smooth operations and avoid